The article was penned by Atty. Laisa M. Alamia, Minority Leader and Member of Parliament. This article first appeared in Access Bangsamoro.

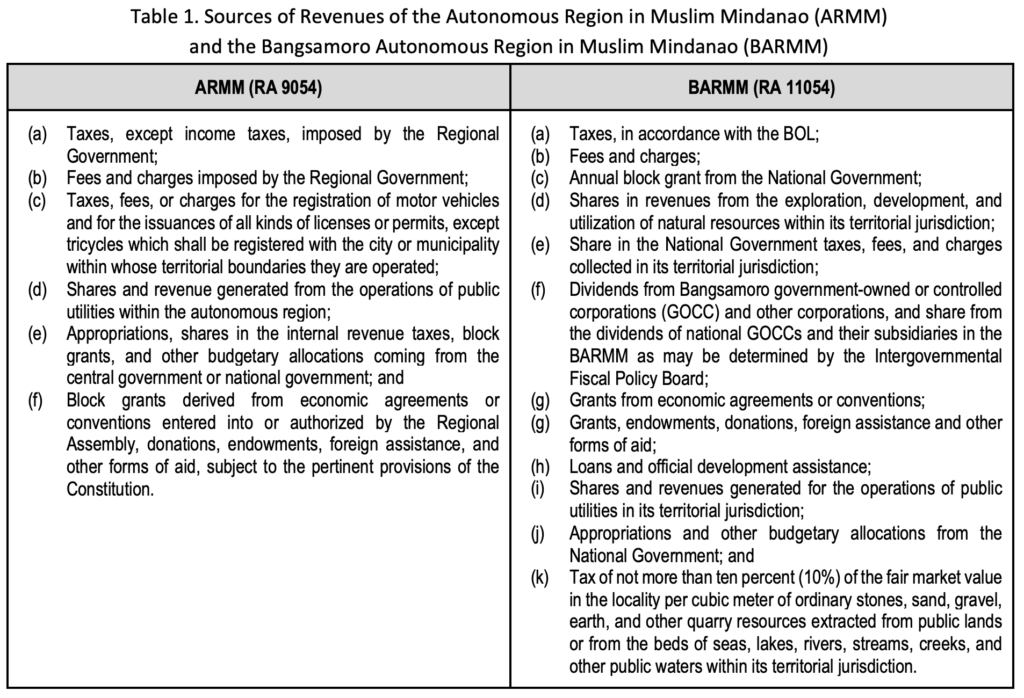

The enactment of the Bangsamoro Organic Law (RA 11054) promises a stronger regional autonomy for the Bangsamoro. At its core, the law provides a new fiscal arrangement that vests an increased degree of fiscal autonomy to the Bangsamoro Government. It has expanded the sources of revenues to be tapped by the Government primarily through the annual block grant. This allows an automatic transfer from the national government equivalent to five percent (5%) of the net national internal revenue tax collection of the Bureau of Internal Revenue and the net collection of the Bureau of Customs from the third fiscal year immediately preceding the current fiscal year.[1]As a result, it has given the Bangsamoro Government an expanded authority over its appropriations. This means that it now has the power to pass its annual appropriations law, departing from the previous approach of submitting it to Congress for review and approval. With this new arrangement, the needs of the Bangsamoro community will be addressed in a more immediate manner with a wider resource.

These liberties all point towards the realization of an autonomous government that is closer and more in line to the cause of the Bangsamoro people. It is important to note, however, that the success of this institutional framework is contingent on how the government can deliver services and programs that respond to the true needs of its people and on how the Bangsamoro community, in turn, can synergize and take part in the development process. This collective commitment among the people involved will ameliorate the projected development of the community.

Bigger Resource, Bigger Responsibility

In the FY2020 proposed national budget, the block grant of the BARMM amounts to PhP70.63B under the Allocations to Local Government Units (ALGU). This reflects a 56% increase, which is PhP39.52B more than the PhP31.11B appropriation for the region in 2019.[2]The effectiveness of this transfer, however, goes beyond its amount. Greater significance should be attached to the responsibility of the government to manage and ensure the sustainability of this fiscal space in the years to come, as well as to give attention to its cooperation with various sectors in the region.

Drawing from the lessons from the ARMM experience, the region’s fiscal autonomy can be better asserted if we anchor it on the following:

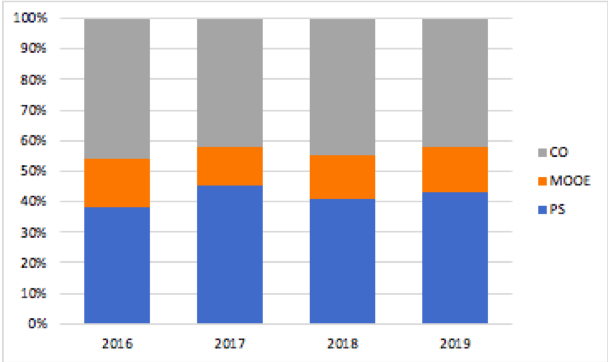

- Managing public funds. The share of the Autonomous Regional Government (ARG) in the national budget had been increasing over the years. In terms of expense class, the ARG appropriated an average of 44% for capital outlay (CO), 42% for personnel services (PS), and 14% for maintenance and other operating expenses (MOOE) in the past four years. This generally shows that expanding government assets had remained to be a priority of the ARG. The minimal appropriations for MOOE, however, demonstrate the need to reevaluate the operations of our offices as to derive relevant services and programs beneficial to the region. Correspondingly, the BOL prescribes an at least 45% appropriation cap for PS.[3]This then can come as a challenge for the Bangsamoro Government to be more innovative on its budgetary priorities.

Figure 1. 2016-2019 ARMM Appropriations by Expense Class

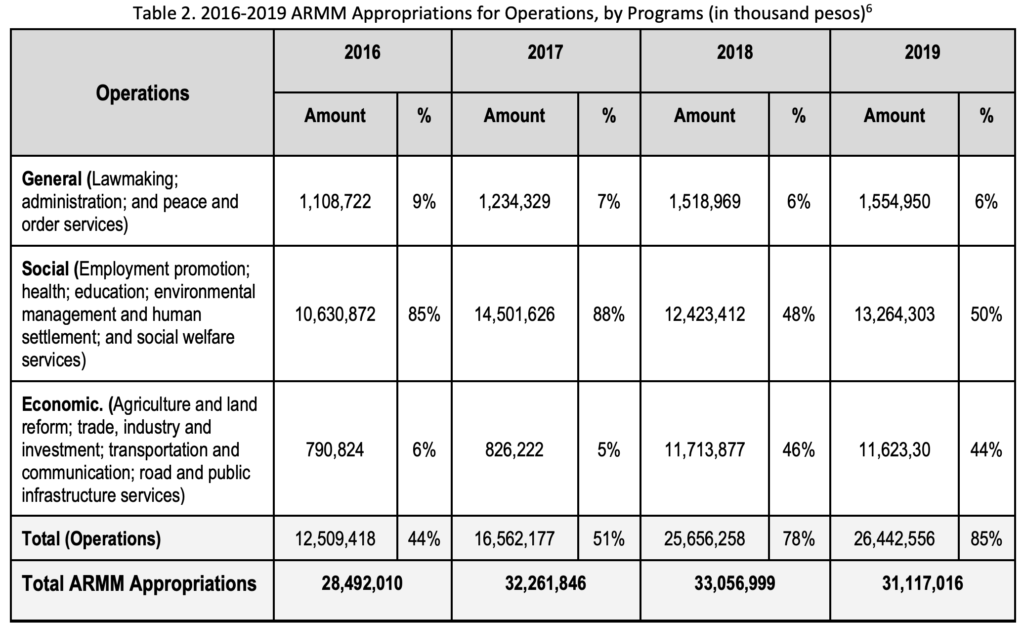

In terms of operations, the ARG’s allocation for its operations had progressed, too: from 44% of its total budget in 2016 to 85% in 2019. Dissecting this further, ARG prioritized social services comprising, on average, 68% of its total appropriations from 2016-2019, followed by economic services at 25% and general services at 7%.[4]Of all programs, education services got the highest appropriation with a total of PhP42.02B in four years, followed by health services with PhP5.28B. The gaps in the appropriation for agricultural services, which only amounts to PhP1.22B for years 2018 and 2019, can potentially be filled by the BARMM regime. This is especially needed because, even with our rich resources, growth rates of Agriculture, Hunting, Forestry, and Fishing (AHFF) sector in the region posed to slow down from 7.7 in 2017 to 5.8 in 2018.[5]It is crucial that we take a look into how government spending can contribute in elevating this sector in the following years.

More than the budget, of course, it is equally crucial that we ensure the efficient utilization of these resources. Now with a bigger fund, we take the responsibility of managing this within the principles of efficiency, accountability, and transparency. This is hinged primarily on how our government can set up a financial management system that will sharpen our obligation and disbursement performance.

Lastly, we at the BARMM should also take the responsibility to ensure that our efforts at the regional level is well-coordinated with national priorities and directions. As such, there is a need to balance fiscal autonomy and accountability by maintaining checks-and-balances and the region’s contribution to the overall development of our country.

- Establishing sustainable finance. It is also crucial that the BARMM builds on its revenue collection capacity. This self-reliance can benefit both the Bangsamoro Government in terms of sustaining its public funds with limited dependency on central transfers and the community at large by having access to greater programs and projects in aid of human development.

From 2015 to 2018, the ARG was able to mobilize locally sourced revenues with a total budget of PhP6.89B.[7]The local fund (LF) constituted the “collections of local taxes by the Office of the Regional Treasury (ARMM-ORT), as well as the ARG’s share in nationally collected taxes”.[8]Through this collection, it was able to fund fifteen (15) agencies including those that are specific and significant in protecting the Bangsamoro culture and basic sectors like the Bureau of Madaris Education, Regional Commission on Bangsamoro Women, Regional Darul Ifta, and Regional Reconciliation and Unification Commission, among others.

The use of the block grant, within and beyond our transition, should also be geared towards placing sustainable mechanisms that will particularly enhance our capacity to generate more revenue at the regional level. Some ways to do this, within the bounds of the BOL, include strengthening our industries, leveraging technology for economic growth, promoting tourism, and easing business agreements.

- Strengthening civic space and multi-stakeholder cooperation. The BOL promotes democratic and active citizenship. In fact, it enjoins the civil society and basic sectors to participate in various political processes and recognizes the private sector as a prime mover of trade, commerce, and industry.[9]This provision highlights the crucial need for multi-stakeholder collaborations among the government, civil society, the private sector, and the public at large to make our new fiscal arrangement, or ultimately, the BARMM work.

The civil society can contribute by: (a) being a partner of the government in regional policy making processes such as in budgeting and planning activities and public consultations; (b) developing monitoring and evaluation measures to check the Bangsamoro Government’s performance; and (c) contributing to the advancement of civic education. The private sector, on the other hand, can help the government through partnerships on revenue mobilization and service delivery.

The BARMM’s regional autonomy comes from the common aspirations of the Bangsamoro people to establish peace and assert its freedom to pursue its development in accordance to its own particular needs. The government must keep in mind the roots of this demand in order to serve its people properly. It is also crucial that this autonomy is supported by a functional fiscal arrangement that will not only allow us our right to self-governance, but also strengthen our integrity.

[1]Section 16, Article XII, RA No. 11054

[2]FY2020 National Expenditure Program, FY2019 General Appropriations Act (RA No. 11260), Department of Budget and Management

[3]Section 20, Article XII, RA No. 11054. Total appropriations for Personal Services for one fiscal year shall not exceed forty-five percent (45%) of the total revenue resources of the Bangsamoro Government.

[4]For the purpose of this article, appropriations under ARMM operations are clustered as follows:

- General: lawmaking; administration; and peace and order services

- Social: employment promotion; health; education; environmental management and human settlement; and social welfare services

- Economic: employment promotion; trade, industry, and investment; transportation and communication; and road and public infrastructure services

Sourced from GAA FY2016-2019, Department of Budget and Management

[5]“ARMM Economy”, Philippine Statistics Authority-BARMM.

[6] General Appropriations Act FYs 2016-2019, Department of Budget and Management.

[7]Book VII, Part 15, ARG Transition Report 2019. Access at https://drive.google.com/file/d/1NZZPlVnRAePGoa-jIOYvKd2L8wQsL9Nv/view

[8]Ibid.

[9]Section 3, Article IV and Section 17, Article XIII, RA 11054.