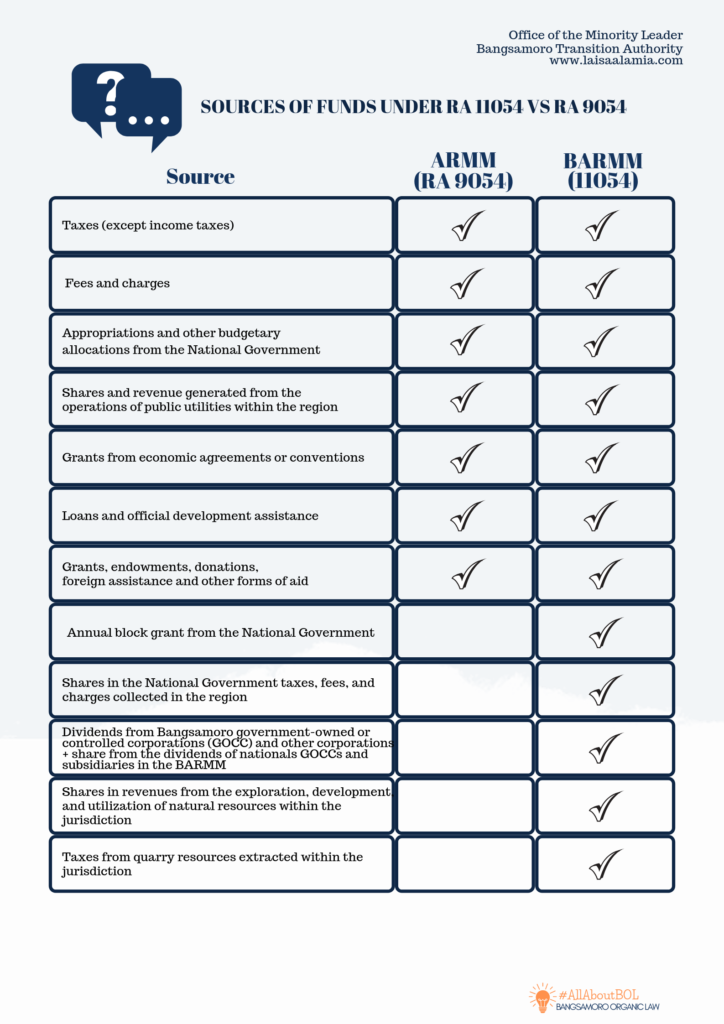

One important feature of the BOL is the expansion of the fiscal autonomy that has been vested to the Bangsamoro Government. This can be summarized into four key points:

✓ The Bangsamoro Government is entitled to additional fund sources such as the annual block grant that will be automatically appropriated in the General Appropriations Act of the Congress, shares in the National Government taxes collected in the BARMM, and dividends from Bangsamoro GOCCs, among others.

✓ The Bangsamoro Government’s taxing powers has also been expanded. It can now impose additional taxes particularly Capital Gains Tax, Documentary Stamp Tax, Estate Tax, and Donor’s Tax.

✓ The BARMM’s share from the taxes collected by the National Government is now increased to 75%, inclusive of the shares of its constituent LGUs. The defunct Autonomous Regional Government along with its provinces and cities were only entitled 35% each previously.

✓ The Bangsamoro Government can now enact its own regional appropriations law, departing from the previous practice of preparing and submitting an annual budget to Congress for review and approval.

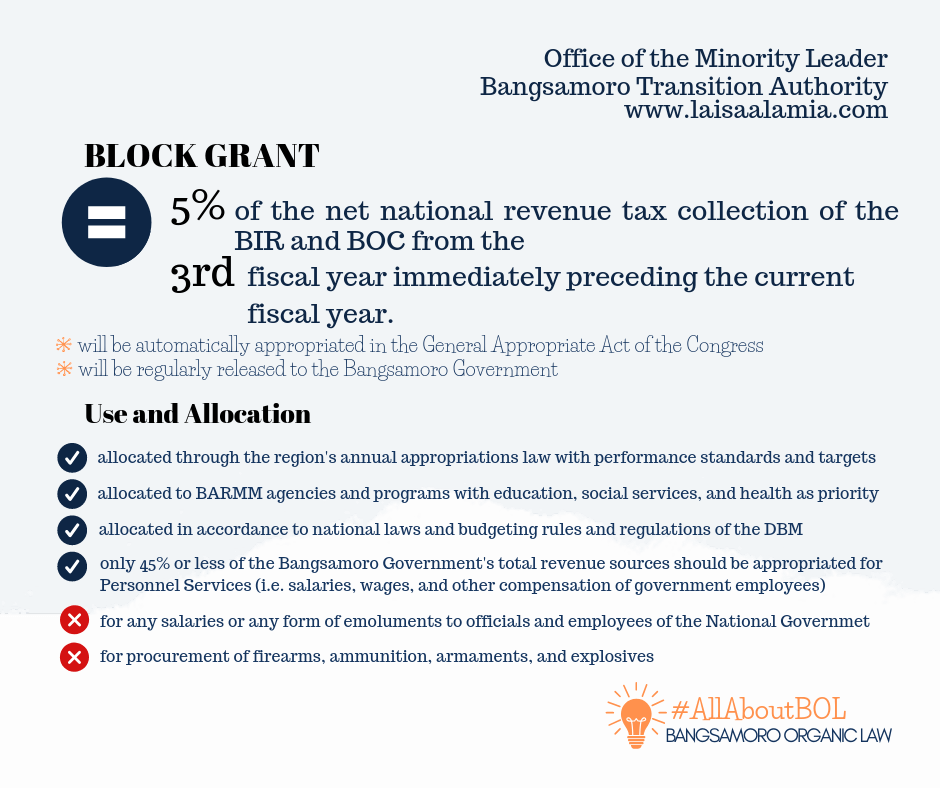

The largest chunk of BARMM’s resource is the annual block grant that the National Government will appropriate for and transfer to the Bangsamoro Government every year. This is the Bangsamoro Government’s share in the national internal revenue tax collections of the Bureau of Internal Revenue (BIR) and the Bureau of Customs (BOC). This is equivalent to five percent (5%) of these collections (net) from the third fiscal year preceding the current fiscal year.

The Bangsamoro Government has the liberty to allocate this block grant to its agencies and programs by enacting an appropriation law annually. This is, of course, subject to some limitations. Some of which are: (a) the Bangsamoro Government cannot appropriate more than 45% of its total revenue sources to Personnel Services; (b) highest budgetary priority should be assigned to education, health, and social services; and (c) it should not be appropriated to provide any form of emoluments to National Government officials and employees, as well as to procure firearms, ammunition, armaments, and explosives.

Moreover, the BOL states that the Bangsamoro Government and its constituent LGus shall be audited by the Commission on Audit (COA). It also creates a Bangsamoro Treasury Office to receive and safeguard all revenues generated and collected by the Bangsamoro Government, and a regional Bureau of Local Government Finance (BLGF) to coordinate, assist, and monitor the treasury and assessments operations of the BARMM LGUs.

This article forms part of the #AllABoutBOL Series published by the Office of the Minority Leader – BTA as an effort to explain and raise awareness on the Bangsamoro Organic Law (Republic Act No. 11054). For questions or comments on the Series, contact us through this link.